What is an ETF Portfolio?

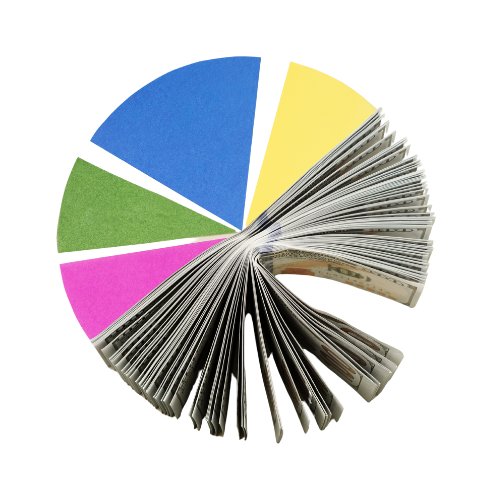

An ETF Portfolio is a curated mix of ETFs across equity, debt, and commodities. Designed for stability and long-term growth, it allows investors to gain broad exposure to various asset classes efficiently.

- 📈 Market-wide diversification

- 💡 Cost-efficient investment model

- 🔍 Transparent & actively balanced